closed end credit def

Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is.

What Is A Closing Date On A Credit Card

To understand it better a line of credit as used in the definition is a pre-approved amount of money that is extended by a lender and goes into a borrowers special.

. With the closed-end loan the borrower. This loan must be paid including interest and financial charges within a. Capital does not flow into or out of the funds when shareholders buy or sell.

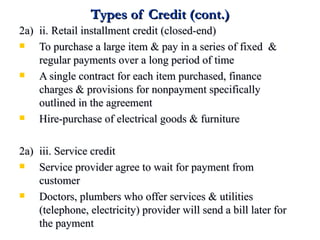

Most credit cards are unsecured meaning no deposit or collateral are required secured cards require a security deposit that typically becomes the cards credit limit. It remains open and it. Closed end credit is a type of loan which entails a fixed amount of funds sometimes for a specific purpose.

A credit arrangement to be paid in full by a specified date is closed end credit. Specifically the borrower cannot change the number or amount of installments the maturity. For example in an.

A home equity loan is classified as a closed-end second mortgage and in contrast a HELOC would be an open-end loan. For example in an. In closed-end credit facility credit proceeds must be paid.

Closed-end funds are closed in the sense that once they raise capital via an initial public offering IPO no new money flows into or out of the fund. Closed-end credit is used for a specific purpose for a specific amount and for a specific period of time. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date. Payments are usually of equal amounts. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower.

Closed-end funds are one of two major kinds of mutual funds alongside open-end funds. Most real estate and. Since closed-end funds are less popular they have to try harder to win your affection.

Mortgage loans and automobile loans are. An agreement in which advanced credit plus any finance charges are expected to be repaid in full over a definite time. A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date.

Advantages of Open Credit. Closed-End Credit Law and Legal Definition. A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end.

Closed-end credit is a type of loan or credit agreement signed between a lender and a borrower that includes details about the stipulated amount borrowed interest rates and.

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Federal Register Truth In Lending Regulation Z

Clear To Close What Does This Mean

What Is A Credit Utilization Rate Experian

Open Vs Closed End Leases What To Know Credit Karma

What Is Open End Credit Experian

Understanding Finance Charges For Closed End Credit

How Many Movies Credits Go Uncredited

Create End Credits In Premiere Pro 2018 Youtube

Everything You Need To Know About Closing Cost Credits A N Mortgage

What Is A Closed End Fund And Should You Invest In One Nerdwallet

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

What Are Three Types Of Consumer Credit

What Is The Meaning Of Closed Settled And Written Off In Your Credit Report

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)